The Government Will Pay You to Keep Your Employees Employed

As expected, the Senate passed an economic stimulus bill Wednesday evening which includes a provision to assist small businesses.

If you employ 500 or fewer employees, please read this.

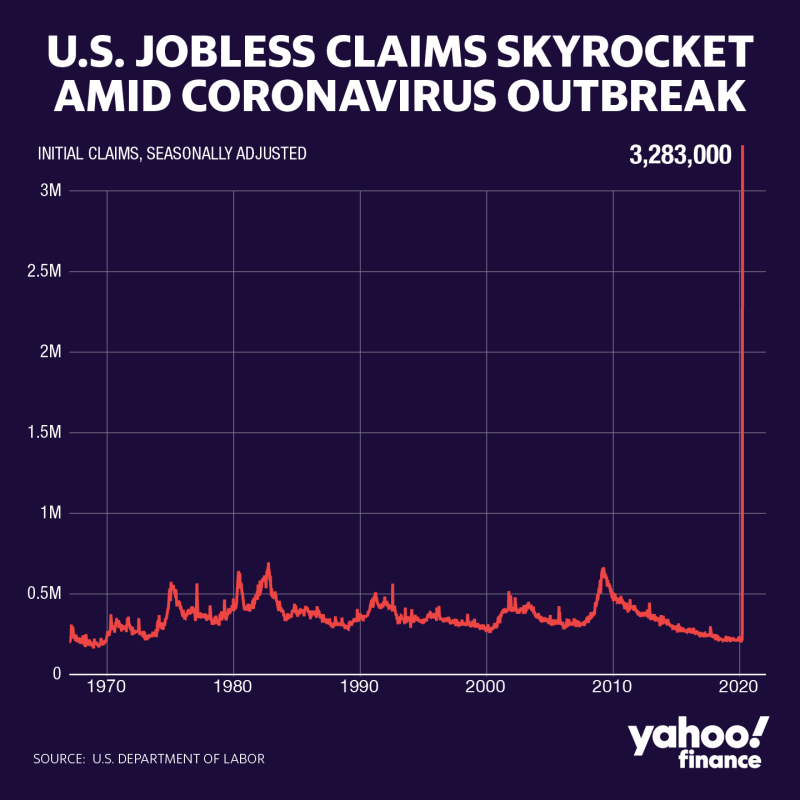

This morning’s (Thursday) weekly jobless numbers were released showing 3.28 million people sought unemployment in the past week. For context, the prior record was a mere 695,000 in 1982. This record was annihilated in the past week due to COVID-19.

These numbers are extremely concerning for everyone – especially the elected officials who depend on our votes to keep their jobs. Congress, the Treasury and the President knew this was coming and passed a stimulus bill.

The stimulus bill has provisions for your business.

Released last night, the 880-page bill includes a provision called the “Paycheck Protection Program” (section 1102, page 9). This is the section outlining the forgivable loans business owners can access, so they effectively function as grants.

This update is an overview of the requirements for accessing these funds. More details are forthcoming.

This program is designed to assist businesses and nonprofits to pay payroll and overhead costs for eight weeks.

- These loans will be available through FDIC banks and FCUA credit unions.

Secretary Steve Mnuchin is aiming for these loans to be approved on the same day as the application! (As someone who has written SBA loans, this is mind-blowing).

Others have suggested a 3-day turnaround. Regardless, it is going to be lightning speed considered to most loans.

- Funds are to cover payroll costs and overhead costs.

Funds can include payments to independent contractors, sick leave, the FMLA-style requirements recently placed on employers under 50 employees, health insurance premiums, retirement benefits, so long as those individuals are not earning more than $100k and are living in the US.

- These funds are to be used for the following purposes:

- Payroll costs

- Health insurance

- Mortgage interest on real estate debt (not principal)

- Rent

- Utilities

- Interest on other debt incurred before February 15, 2020. (Section 1102, p. 20)

- The loan proceeds used for this purchase are eligible to be forgiven

The amount expected to be forgiven needs to be given to the lender within 90 days (the onus is on the borrower to track all eligible expenses). (Section 1106, p. 41.)

- To receive loan forgiveness, you will need detailed records of employee’s pay rates, payroll tax filing reports, unemployment filing and canceled checks for rent and utilities.

While these don’t appear to be exorbitant record keeping requirements, be aware that you will need to produce documentation to have your loan forgiven.

- Any forgiven loan is not taxable income. (Sec 1105, i)

As of March 26th, this has not been signed into law. I expect it to be signed this weekend.

I will be studying this program to learn more about this in the coming days. I strongly encourage you to consider this program to keep your employees employed and cover the cost of your business in this insta-recession.

As always, reach out to me with any questions.

You can reach me at paul@redearthcpa.com.