Swallow the Bitter Pill – Ask for Help

You know the news and have seen the headlines. Not since 9/11 have I seen our nation so attentive to a single issue.

I want to talk about your business here.

Your business needs you to be a leader, make hard decisions and keep it healthy. Maneuvering your way through this health crisis has implications far beyond today.

1. Be realistic about the risks to your business

The current pandemic is disrupting the business world in a way never seen before. Businesses are being forced to close and entire industries are facing economic catastrophe. The April 2nd weekly unemployment claim showed more than 6.6 million people filed for unemployment in one week! This is 10X the record from 1982! No one even has a good idea when this will end.

Not long ago, certain politicians were hoping to restart the economy by mid-April. March 31st, the Cornonavirus Task Force displayed a graph of the predictions of the spread and mortality of the virus. The models now show it peaking mid-April. They are now predicting between 100,000 – 2.2 million fatalities as a result of this virus.

The Federal Reserve Bank of Saint Louis is predicting peak unemployment to touch 32.1%. For comparison sake, peak unemployment in the “Great Recession” of 2007-2009 was 10% and unemployment during the “Great Depression” was only 25%.

I hope all the experts, both healthcare and economic, are wrong. You may disagree with their assumptions, but these are not ignorant people.

In the book Good to Great by Jim Collins, he tells a story about Admiral Jim Stockdale. The admiral spent eight years in a Vietnam POW camp. He survived being tortured more than 20 times. When asked what the personality traits of those who didn’t survive the camp he responded quickly,

“That’s easy, the optimists are the ones who didn’t make it out”.

Collins continues to make his point, “This is a very important lesson. You must never confuse faith that you will prevail in the end – which you can never afford to lose – with the discipline to confront the most brutal facts of your current reality, whatever they might be.”

This is a very difficult shock to the economy and your business. If you want your business to survive, you will need to act decisively and make difficult decisions.

2. Protect cash

I write about cash and cash flow frequently for a reason, it is the lifeblood of your company. In the same way, if you lose blood you will perish, not collecting and having cash will cause your business to fail.

- Call your lenders and landlords. Let them know about the hardship. Many lenders are offing deferral terms to their borrowers. Government-backed loans like the SBA, FHA, Fannie Mae and Freddie Mac are making provisions for people not paying their loans.Large, publicly-traded companies have warned they will not be able to make their rent payments. The backlog of businesses not paying their vendors will impact you.These companies are doing everything possible to save their cash.

- Halt distributions. Distributions (and draws) are payments made to the owners of the business as a reward for being an owner. Because we are in such a volatile time, owning a business is not as rewarding now. These cash payments should be minimized or eliminated for the next 90 days.As a point of reference, many companies previously considered “A” rated by the rating agency are halting dividend payments to their owners. One well-run company, TJ Maxx, despite being one of the best brick and mortar retail companies, laid off most staff, cut their dividend completely and drew the max on their operating line of credit.You’re not in the retail space but this is decisive action taken by a leading company. Acting sooner than later may mean your business survives.

- Slow payments to vendors. Hold the cash as long as you can before sending it along. If you are having trouble, contact your vendors and talk with them. They want you to stay in business. They don’t want to find another customer, but they need customers who will communicate. Treat your vendors right but stay in control of your accounts payable by not rushing money out the door.

3. Ask Uncle Sam for help

On Friday, March 27th the President signed the Coronavirus Aid, Relief, and Economic Security (CARES) Act. There are important provisions in this bill that are designed for your business to weather this crisis.

You need to act!

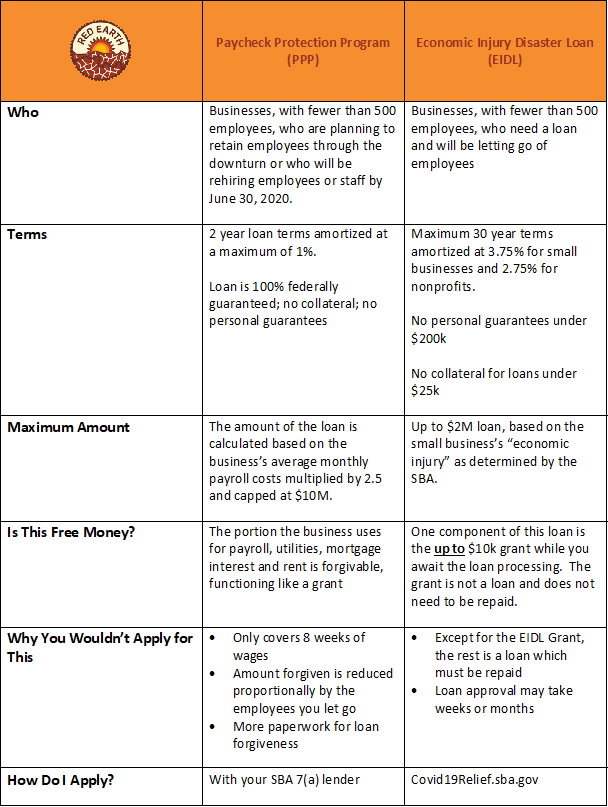

There are two main programs both offered through the Small Business Administration (SBA). They are the Economic Injury Disaster Loan (EIDL) and the Paycheck Protection Program (PPP).

These programs are an either/or, so you need to know which program to apply to. Depending on your circumstances, you will receive more funding through one than another.

This is free money for your business. If you don’t take it, your competition will (and we will all pay it back!).

I’ve put together a table with the help of some really driven CPAs.

This table is intended to be the beginning of the conversation about these options. (I have updated this several times as of 4/8 and plan to keep this current. Please check the latest news before applying.)

Unemployment is not the worst option

One other government option is unemployment. While this is not the desired outcome, the generous unemployment benefits being offered currently include an additional $600 per week through July offered by the federal government. In fact, many employees will make more money on unemployment than working creating a disincentive for work, at least through July.

The increased payouts to your ex-employees may make the decision easier. While the government is working hard for businesses to not lay off employees, you must make decisions for what is in the best interests of the business, not employees or the government.

Your business may be asymptomatic

Some people say they don’t need to apply while others have already made severe changes.

I have two thoughts on this. First, the world is more connected than it has ever been. If a 32.1% unemployment rate is reached (or even half that rate) is your business really not going to be impacted?

Are you telling me your business’ pricing power wouldn’t be impacted if a third of Americans were looking for work? I have serious doubts for anyone telling me their business isn’t impacted by this.

Secondly, even if your business is doing well now, maybe it is just asymptomatic. Like the coronavirus, this may be the infected period before the symptoms. Cash and a right-sized business are the cure for that disease.

The time to get money is when you don’t need it.

I’m here to help. I’ve been working with clients to find their optimal government benefit and I’m happy to help you.

The worst thing you can do is nothing.

Email me at paul@redearthcpa.com.