How to Match Inventory in Your PSA with Your Accounting File

Spending hours reconciling inventory in your accounting file to your professional service automation (PSA) every month is a complete waste of time. Not only does it cost you time, but you may also inadvertently be messing up your financial statements. Fortunately, there is an easier way to close your books monthly without needlessly spending hours in the minutiae.

Understanding Inventory Valuation

Inventory in this context refers to items you own and intend to sell, not items drop-shipped to clients. Your inventory is physically held on-premise or at an offsite location and has not yet been sold, which is why it is on your balance sheet. The key aspect is ownership of this asset.

The quantity of inventory is located in your management system, the PSA and/or the accounting file. The value of the inventory is the quantity on hand times the price (which varies depending on the method). To determine the inventory quantity, most companies conduct a physical count at year-end and adjust balances accordingly.

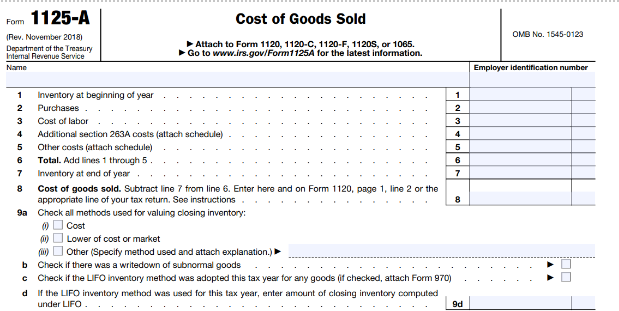

If you have been operating a business with inventory for more than a year, your business already has a method of valuing inventory. You can find out what it is by looking at your tax return. On Form 1125-A, you will find a checkbox of the current method: Cost, Lower of cost or market, LIFO, or Other.

In addition to what is chosen on your tax return, your accounting file also has a default method (and hopefully, it is the same!).

If you’re using QuickBooks, inventory valuation varies by version:

- QuickBooks Desktop Pro or Premier uses average cost.

- QuickBooks Online operates on first in, first out (FIFO).

- QuickBooks Enterprise offers either average cost or FIFO.

Furthermore, your PSA also has an inventory valuation method. If your PSA and accounting file are recording inventory differently, they are fundamentally irreconcilable, and your Cost of Goods Sold (and profit) will always vary. In this case, no amount of reconciling will attain the results needed because the PSA and accounting file are not recording this asset in the exact same way.

Transitioning to QuickBooks Online

For those using QuickBooks Enterprise with FIFO and transitioning to QuickBooks Online, the inventory method remains consistent. If you’re moving from QuickBooks Desktop Pro or Premier to QuickBooks Online, you’ll shift from using an average cost method to FIFO, the only method supported by QuickBooks Online. This change constitutes a change in accounting method.

The IRS requires notification for inventory method changes. To comply, file an “Application for Change in Accounting Method,” indicating how this shift affects your financial statements.

Why Make Your Life Harder

Maintaining duplicate inventory records in both your PSA and accounting software provides no real benefit. Instead, focus on keeping a single accurate inventory list in your PSA and use monthly reports from your PSA to update your accounting file. Adjust the inventory in the general ledger to match the PSA with a journal entry (through Hardware Cost of Goods Sold (COGS)). This will save hours of frustration trying to align balances that may not fundamentally balance.

Key Recommendations

- Consolidate Inventory Management: Use your PSA as the primary inventory record to streamline processes and minimize reconciliation errors.

- Monthly Reporting: At month-end, generate an inventory report from the PSA and use it to update your accounting file. Use journal entries to align your general ledger with PSA inventory values.

- Documentation and Consistency: Regularly update balances and maintain a consistent valuation method across your PSA, accounting file, and tax return.

Use a Single Report for Inventory

Managing inventory effectively is crucial for maintaining accurate financial reports and operational efficiency. However, attempting to keep perfect records in both your PSA and accounting software leads to unnecessary work and complexity. Instead, prioritize your PSA as the sole location for inventory management. Doing so enhances financial accuracy and allows for more strategic focus, freeing you from time-consuming reconciliations.