One of the most common financial mistakes business owners of S-corporations make is paying themselves too much in salary. While it may seem like a way to reward hard work, overpaying yourself as a business owner can actually weaken your business and increase your tax burden.

When you’re overpaying yourself as a business owner, you not only put unnecessary strain on your company’s financial situation but also end up giving away more money to the IRS in payroll taxes. Many business owners don’t realize that they are hurting both their business and personal financial situation by having their compensation structured wrong. This post will help you decide how much to pay yourself so you can take home more money while keeping your business strong.

There are multiple reasons why you don’t want to overpay yourself.

Business owners who set their salaries too high often fail to recognize the tax implications associated with their decisions. While a high salary may feel rewarding, it also means paying more payroll taxes like Social Security and Medicare (FICA). These payroll taxes apply to both the employer and the employee. FICA alone amounts to an additional 15.3% in taxes on wages (split between the business and employee; up to the social security maximum). This hidden tax is deducted from every paycheck, making it easy to overlook.

In addition to payroll taxes, for owners of S corporations, too high of a salary actually forfeits a deduction. Profits are taxed more favorably than wages due to the qualified business income (QBI) tax deduction. When you take a high salary instead of lowering your wage and taking the difference as distributions, you are forfeiting a tax advantage.

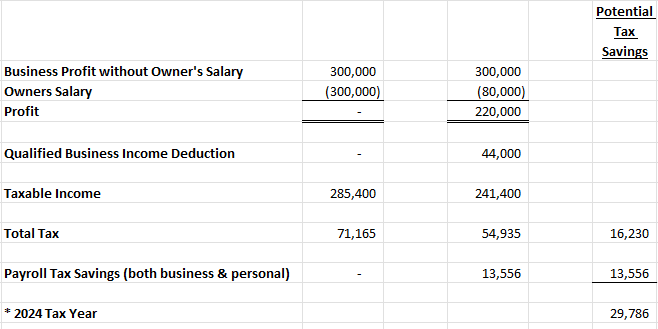

For example, let’s consider the owner of an S-corp with a profit before owner compensation of $300,000. This owner can choose to pay themselves a $300k salary or a lower amount (to the base of a “reasonable salary”); for this example we’ll use $80k.

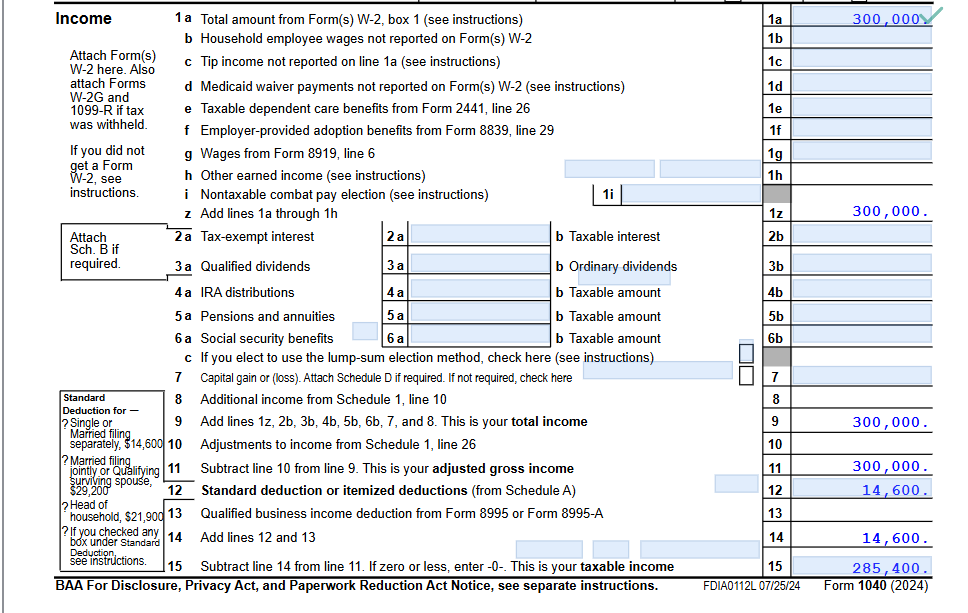

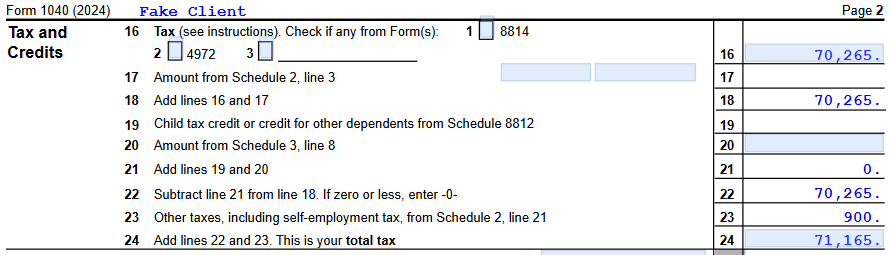

For a $300k salary, the wage is taxed at the full $168,600 2024 maximum FICA tax generating $25,795 in FICA payroll taxes between the company and the employee. In addition, the amount above the FICA limit is still subject to the additional Medicare tax (1.45%) resulting in $900 (line 23 on the return below).

Switching to the income tax equation, with no other income or deductions, this creates a total tax bill for an individual with the standard deduction of $71,165 (including the $900 additional medicare tax).

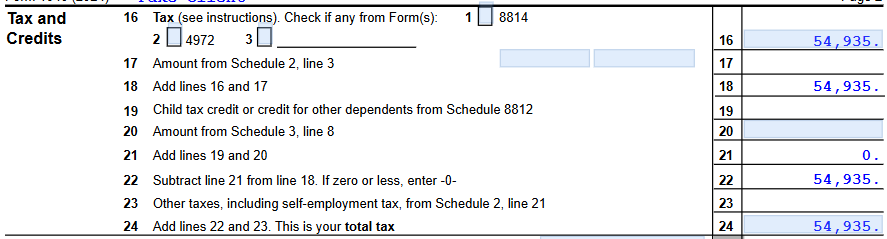

The $300k salary maximizes the FICA tax for both the business and personal while eliminating the QBI deduction. This is what a 2024 tax return would look like for a business owner paying themselves a $300k salary with no other deductions, and no profit:

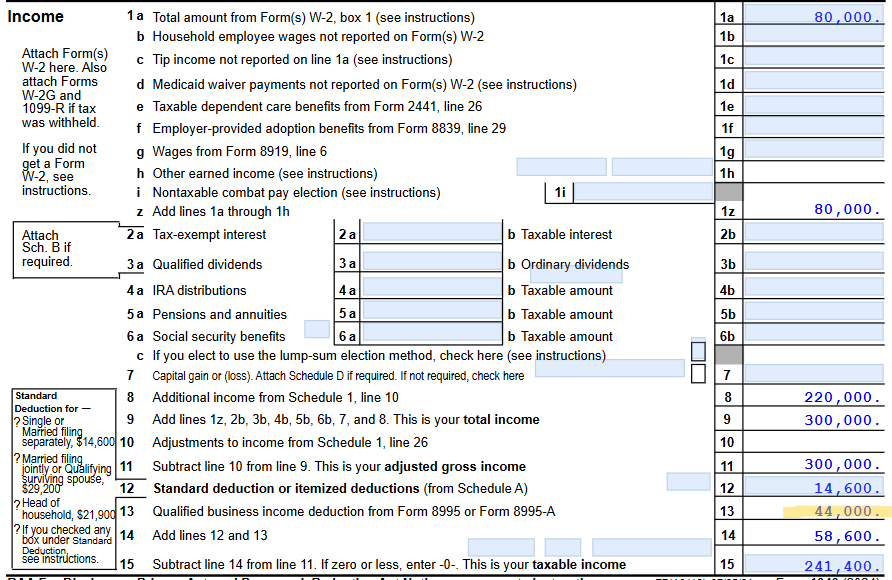

Watch what happens, however, when we lower the salary to $80k.

The first result is the combined payroll taxes are now only $12,240 ($80k * 15.3%), but you won’t see that on the income tax return. The payroll tax savings alone between these two examples is a not insignificant $15,556 (not including the additional $900 in Medicare). Payroll taxes are notoriously difficult to trace, many have no idea how much they’re paying in payroll taxes. (You will see them deducted without fail in your payroll register though!)

Switching to the income tax component, that same unprofitable business now generates a profit of $220k. That profit produces a 20% QBI deduction for the owner of $44,000. It looks like this on a 2024 tax return:

The resulting total income tax is now reduced to $54,935, a savings of $16,230. Keep in mind, the compensation to the owner is still $300k but now it’s a combination of salary and profit (removed as a shareholder distribution).

The combined tax savings between payroll and income taxes is over $29,000, all without reducing income to the owner!

The Right Way to Pay Yourself

A smart approach to owner compensation is balancing salary and distributions. While a salary is necessary and should be reasonable, S-corporation owners can take additional income through shareholder distributions, which are not subject to payroll taxes. This strategy can save a significant amounts of money over time.

Industry benchmarks can help determine what a reasonable salary should be. Business owners often resist lowering their salaries because they believe they “can’t live on that low salary.” However, when combined with profit distributions, total take-home pay remains healthy without the burden of unnecessary payroll taxes. This approach allows for a more tax-efficient way of compensating oneself while ensuring the business retains enough capital to grow.

Another thing to remember is that distributions should only be taken when the business is profitable. If a company isn’t generating enough revenue to support owner distributions, it’s a sign that the financial health of the business may not be as strong as the owner thinks. Taking a high salary in this situation makes things worse. It drains the company of resources that could help strengthen operations and drive profitability.

Business Profitability Comes First

A business must generate steady cash flow to remain viable. Service-based businesses operate on consistent cash flow, and overpaying yourself as a business owner can disrupt this balance. When profits are drained through excessive salaries, less money is available for reinvestment in the business, making it harder to scale, hire new talent, or improve operations.

A responsible business owner must adjust if the company isn’t profitable. If cuts are necessary, they should take a pay cut first. However, many owners take salaries above market rates. They unknowingly hurt their own business’s sustainability.

A business that doesn’t generate enough profit to sustain itself will not survive long. If a company can’t support distributions while staying profitable, financial adjustments are needed. In this case, owners should consider reducing salaries. This helps keep the company financially healthy.

Tax Planning to Avoid Surprises

Many business owners struggle with quarterly estimated taxes, leading to stress and penalties. The solution is simple: adjust your tax withholdings on your paycheck to cover tax obligations automatically. Instead of scrambling to pay taxes four times a year, increase your paycheck withholdings to avoid the hassle.

Tax planning helps business owners keep more of their money. Structuring compensation correctly reduces unnecessary tax payments and helps owners retain more earnings. Overpaying yourself as a business owner through your salary results in extra payroll taxes. As a result, they give more money to the government than necessary. Instead, they could reinvest that money in the business or take it as lower-taxed distributions. Effective tax strategy isn’t just for tax season—it’s a year-round effort. Reviewing industry benchmarks, like those in the Service Leadership Compensation Report, can help business owners ensure they’re paying themselves appropriately while maximizing tax efficiency.

How to Get Your Compensation Right

The best way to determine the right salary is by comparing it to industry standards. Reports from groups like Service Leadership provide benchmarks on what business owners in different sectors earn. Paying yourself a reasonable salary not only optimizes tax savings but also prevents IRS scrutiny.

Beyond setting the right salary, business owners should plan for regular distributions. A structured distribution schedule ensures steady income while keeping tax burdens low. However, only take distributions when the business has enough profits to support them.

Compensation is not a set-it-and-forget-it decision. As your business grows, you should review and adjust your salary and distributions. Owners who don’t reassess their compensation risk creating an unsustainable salary structure that hurts both their business and personal finances.

Conclusion: Pay Yourself Smart, Not Just More

Structuring your compensation correctly helps maintain business profitability and personal financial stability. The goal isn’t to take the biggest paycheck—it’s to maximize your take-home income in the most tax-efficient way. Avoiding excessive payroll taxes by balancing salary and distributions ensures you keep more of what you earn while keeping your business financially strong.

A successful business supports its owner with a reasonable salary while allowing for extra income through distributions. This method cuts tax costs while keeping enough capital in the company to grow. By managing salary and profit distributions wisely, business owners can secure their personal finances and long-term business success. So, take control of your compensation, stop overpaying yourself as a business owner, and put your business back on track.

If you found this post helpful, check out How Much Should I Pay Myself, where we break down salary vs. distributions in detail. Learn how to handle profit distributions from your S-corporation without tax headaches in Four Facts About S-Corporation Distributions. If you want to maintain healthy cash reserves and strengthen your business’s financial stability, read How Much Cash Should I Keep In My Business