Many business owners struggle to understand the difference between a budgets vs. cash flow forecasts, but knowing how each works is essential to financial success. Managing your company’s finances like a boss requires the right tools. Two essential tools for planning are budgets and cash flow forecasts. While they may seem similar and are often confused, they are created differently and serve different purposes. Understanding how they work and when to use each can help you stay profitable and avoid cash shortages.

Let’s break them down.

What is a Budget?

A budget is a financial roadmap. It outlines a business’s values, goals, and financial intentions for a specific period (monthly, quarterly, or annually). Created at the beginning of the year, it serves as a communication tool and reference point for financial performance.

A budget includes:

- Revenue targets – Expected top line sales for a set period

- Fixed and variable costs – Regular expenses such as rent, payroll, and supplies

- Expected Profitability – Estimates of net income after expenses

Budgets are typically based on accrual accounting. This means revenue is recorded when an invoice is issued, and expenses are recorded when the bill is received. This method provides a more precise picture of profitability, even if no cash has been exchanged.

Example: MSP Budgeting

For Managed Service Providers (MSPs), a budget includes monthly revenue goals (recurring and non-recurring), hardware cost of good sold, team member costs (both cost of goods sold and administrative expenses), software subscriptions, and expected profitability. The revenue aligns closely with the sales pipeline, since invoices follow sales with a fairly predictable lag.

Budgets are created annually and broken into monthly or quarterly targets. Once set, manage to the budget. Unlike a live budget, the highest performing companies don’t update their budgets during the year. Bonus structures are created from these budgets and team members figure out how to do what’s expected of them to acheive the desired results.

What is a Cash Flow Forecast?

A cash flow forecast focuses on the timing of money moving in and out of the business. Unlike a budget, which projects profitability, a cash flow forecast ensures a company has enough cash to meet obligations.

A cash flow forecast includes:

- Cash inflows – Expected payments from customers

- Cash outflows – Expenses such as payroll, rent, and loan payments

- Running cash balance – Ensures the company does not run out of money

Unlike budgets, cash flow forecasts follow a cash accounting method. Revenue is recorded only when cash is received, and expenses are recorded when cash is spent. The purpose is to track liquidity, ensuring funds are available to cover bills.

A business can be profitable on paper but still fail if it doesn’t have enough cash to pay rent, make payroll, or cover a credit card bill. Cash is your company’s lifeblood. Running out of it is the top reason small businesses fail.

Cash flow forecasts are typically shorter-term. Many businesses use a 13-week rolling forecast, which provides visibility into financial needs for the next quarter.

For MSPs, managing cash flow is critical. If payroll and supplier costs are charged to a credit card, timing payments correctly prevents financial strain. The worst situation for any business is running out of cash. Without it, even profitable companies can fail.

Forecasts help you answer questions like:

- Can we cover payroll next Friday?

- How much will we need to draw from our line of credit this month?

- When will that large client payment land?

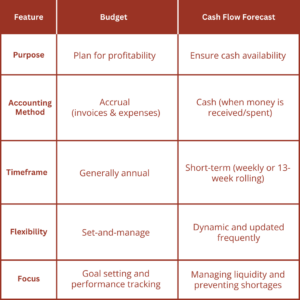

Key Differences : Budgets vs. Cash Flow Forecasts

Why You Need Both

Both a budget and a cash flow forecast are essential financial tools. A budget and a cash flow forecast are not interchangeable, but they are complementary. Together, they give you a more complete financial picture. To build a strong financial foundation:

- Start with a budget to set your goals and monitor financial performance over the year.

- Use a cash flow forecast to make sure you can meet your day-to-day financial obligations.

For example, your budget might tell you that you expect to make $1,200,000 in revenue next quarter. But your cash flow forecast will tell you that half of that revenue won’t hit your account until a month later after rent and payroll are due.

By using both tools, you can:

- Plan for profitability

- Avoid cash shortages

- Make smarter spending decisions

- Build trust with stakeholders and lenders

Tools to Get You Started

You can build both tools using your accounting software. Many platforms offer budgeting modules, and cash flow forecasting tools are increasingly integrated into cloud-based systems. Understanding the difference between a budget vs. cash flow forecast is key to making informed financial decisions and building a stronger, more resilient business.

At Red Earth CPA, we help clients build both budgets and cash flow forecasts tailored to their business model, especially MSPs. Whether you need help setting revenue targets, projecting cash availability, or just want to avoid sleepless nights over payroll, we’ve got you covered.

Ready to get started? Connect with us here to explore how budgeting and cash flow forecasting can support your business goals.