How Detailed Does My Chart of Accounts Need to Be?

The chart of accounts (CoA) is one of those phrases that makes eyes glaze over. Up there with the terms “basis” and “depreciation”, the very mention of the phrase plunges the conversation deep down the rabbit hole and signals to non-accountants that it is time to find another conversation.

As you continue to invest in the infrastructure of your business by creating a quality accounting system that can scale, you will want to spend time thinking through your chart of accounts. However, before we can discuss specifics, we need to step back and ask some bigger questions.

What is the purpose of your financial statements?

This may be the “What is the purpose of life?” question for accountants. While we all know there should be a purpose for your accounting books, many businesses live like there is functionally no value to them.

Seemingly on a parallel plane, accountants approach their work with (arguably) an over-emphasis on the details, completely obscuring the purpose for which financial statements exist. Many discussions about the latest guidance for the treatment of a lease or an expense are merely a dog whistle to those select few who actually understand the minutia about which they are communicating.

Where the owners sit, at the 30,000-foot view of the company, the financial statements are quite simple.

Accounting records exist to tell the story of the business.

Structuring your CoA simply defines how you want to narrate your business’ story. The accounts you track will dictate the narrative to your current and future stakeholders.

If your accounting file is merely to file a tax return once a year, you will want to make it easier on yourself and keep the CoA as simple as possible.

If your purpose includes tracking separate business lines, tracking gross and net margins or assigning responsibility for different aspects of your business, craft a CoA to tell your story.

Where is your business going?

Yet another philosophical question about your business that will impact the tactical aspect of accounting, your plan for the direction of the business dictates the usefulness of the accounting records.

Are you planning to scale and sell the company?

If you are planning to sell your business, take time to understand what the market wants. Higher margin projects need to be separated from recurring revenue in both revenue and COGS setup. You can help yourself by mentally placing yourself in the position of the purchasers. In the lead-up to a sale of a business, the purchasing company spends an incredible amount of time understanding the cash inflows and outflows of the business. They want to see which lines are profitable and growing. The easier you can make it on the purchaser to understand, the more suitors you will have and the higher value you will command.

Do you want to hire management and handoff responsibility as you grow your company?

In this circumstance, you may want to break down the revenue and COGS codes by the responsibility of the manager. Clearly articulate product and service lines by the individuals responsible for their margin to minimize confusion. Create order in your company by thinking through who is going to manage your company and how you will hold them accountable.

How much time do you want to spend on accounting?

Crafting a detailed CoA is a laborious endeavor. The reward to the business must be greater than the effort and expense to categorize and track the details of the business.

A major tenant of accounting is consistency. Complex and detailed CoAs are difficult to teach, learn and explain to new managers and staff as well as investors. Simply put, consistency is threatened when the system is too difficult to understand.

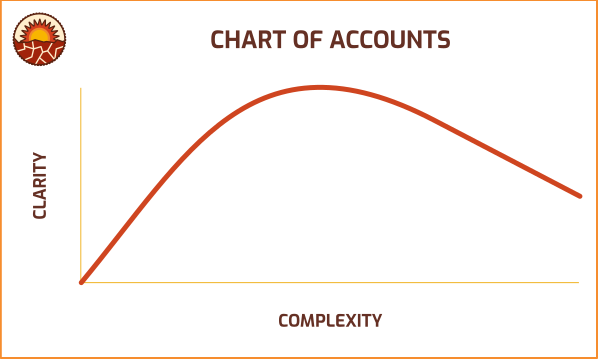

The utility of the CoA only increases marginally before plummeting with excess details. Illustrated in a graph, it would look like this:

The increased complexity increases utility only to a certain extent. After that point, users become frustrated and training for accounting is too complex to create consistency, a requirement for useful financial statements.

Rather than a prescriptive approach, however, these thresholds vary with the size of the company. A $500k company is completely different from a $15M company. The needs will change as the company grows as will your CoA.

Some industry CoAs exceed 150 accounts and may cause you to question if you need to have a CoA so detailed.

You don’t.

You need one that serves your company and communicates your business effectively to your stakeholders. As you grow, you can add more accounts as it makes sense for your company.

What level of detail do your stakeholders require?

Privately held companies with fewer than 5 owners will have different needs than ones with 50 owners. The more eyeballs on the books, the more you need the books to tell a story.

If you have ever sat with a finance board reviewing financial information, you know that too much information is just as bad as not enough. More information begets more questions. There is an art to communicating enough without overwhelming the user.

Don’t make accounting your greatest frustration by unnecessarily complicating your CoA.

Accounting pain is real. So is the cost. Slow down and take your time on this. Just like building a business, it is done one piece at a time.

Jumping into the complicated and fancy CoA may cause you more trouble than it is worth, regardless of who advocates for it.

Without dedicated and trained human resources, the risk that good intentions of detailed accounting result in turnover and frustration is very real. Consider your ability to manage this expense.

The last thing you want is to be the only one who understands the goal and end up doing it on your weekends!