Avoid the Hassle of Estimated Tax Payments by Paying Them Through Gusto Payroll

Another quarter has come and gone and you likely forgot to send in your estimated taxes. You forgot because, like 99.9% of humanity, you are not thinking about tax deadlines as you run your business.

You have more important things to deal with.

Like anything.

How is anyone supposed to remember those crazy dates? There’s little rhythm to them. They are completely non-habit forming in any way.

Besides the schedule, the amount of cash withdrawn from the business to pay the estimates can be substantial. Coughing up that amount can put a squeeze on the business, creating a self-inflicted cash crunch four times a year.

There is a more efficient way to pay estimated taxes that most never consider. A method that can automate tax payments and smooth out cash flow. Best of all it does not cost you a fee from your accountant and it can help you avoid IRS penalties.

First, let’s review what exactly estimated payments are.

The government wants the full tax amount due on time.

Estimated taxes exist because the federal government requires you to pay the right amount of taxes for the tax year as you receive the income. Just like your business would not extend terms over a year to a customer, the federal government doesn’t want to wait until April 15th of the following year to collect its money.

The government wants their money on time.

If you make more money, you are expected to remit taxes on a regular basis. The rules vary based on the income amount but generally to avoid penalties and interest you must remit 110% of your prior year’s taxes or 100% of the current year’s. (This amount varies with the income. If your adjusted gross income is less than $150k, the amounts are only 100% of the prior year’s or 90% of the current year’s taxes.) Four equal installments paid on time will avoid penalties and interest.

On time is a challenge because of the odd dates. The tax calendar is so detached from every other calendar it is easy to mismanage. Estimates need to be paid by the 15th of the months of April, June, September, and January (of the following year). You need to specify the tax year for each April 15th payment since one is the “settle up” date for the prior year and the other is the first estimated payment for the current year.

To say this causes confusion is an understatement. Of all the tax nuances that snag business owners, it seems like estimated tax payments are “smoke in the eyes” frustration for taxpayers. Tax penalties can make many business owners almost lose their minds in frustration that they have no control over assessed penalties. They feel like they are fighting an invisible foe.

Business owners earn much of their income outside the traditional payroll structure.

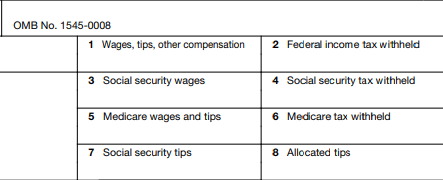

This process is relatively easy for employees, those who earn virtually all their income as wages (reported on form W2). Employees generally know how much income they will receive and, even if variable, can withhold a portion of it to send to the federal government. The money sent to the IRS for federal withholdings is reported in box 2. This amount is remitted to the government biweekly or monthly through the payroll system. The average employee may not realize their employment creates a steady stream of money for the government through this system just by earning a wage, but that is precisely how the system works for employees.

This is not the case for the owner. Business owners create a business that generates income for them. Unlike an employee, often much of the income for a business owner is generated outside wages. Whereas the wages of an employee are subject to federal withholding, the income from the business is not. Most owners make money as an employee and as an owner.

This creates a challenge for the owner when they file their personal tax return. While they may have been withholding and remitting income taxes on their wages, the business income may vary drastically creating additional income (or loss) as it flows through into the personal return.

Here is an example of a business owner understanding his tax withholdings.

As an example, John owns 100% of Tech Support, Inc., an S-corporation with 25 employees. John pays himself a $150,000 salary and earns another $400,000 from the income of his company.

John’s $150k salary will withhold and send taxes to the government on a regular schedule. Unfortunately, the payroll department is expecting John to earn $150k because that is all they can see. They have no way of knowing about the business income. Only John and his accountant know how much this other amount will be.

While John may set up his payroll to be a single employee with no additional withholdings, this will not be enough to cover his tax bill for the following April. In the prior year, John paid $125,000 in federal income taxes. Since his AGI is above $150k, he multiplies his prior year tax liability of $125k * 110% = $137,500 in taxes due for the current year to avoid penalties. (This may or may not cover the full amount of the current year’s tax bill, however, it will ensure he does not owe a penalty.)

Footing a $34,375 check four times a year is lumpy and awkward. Getting into a rhythm, flow or habit is the best way to ensure something gets done. Due to the irregularity of the dates, establishing a habit is very challenging. Estimated payments are probably the least habit-forming aspect of running a business.

While you have great intentions of avoiding underpayment penalties and interest on the lack of estimated payments, the missed (or mistimed) estimated payments will generate a penalty come tax time.

Your accountant usually focuses on paying the full tax bill for the upcoming year.

You may want to avoid this mess by paying your accountant to calculate your tax bill for the current quarter of the current tax year.

This is certainly a common option. It focuses on paying 100% of the current year’s tax bill. Regardless of the prior year’s liability, this option is more exact as it attempts to pinpoint the precise tax owed per quarter to not only eliminate penalties but to have the amount of tax due the following April 15th to be roughly $0.

This requires current accounting records, an involved accountant, and accounting fees.

For those reasons, many forgo this option.

Between the tax penalties and the accounting fees, there needs to be a simpler way of avoiding penalties without calculating estimates four times a year. Fortunately, you can avoid penalties and automate these payments using your payroll provider.

Set up your tax withholdings through your payroll provider to pay estimated taxes and avoid tax penalties.

Let’s not overthink this. You simply need to pay 110% of your prior year’s taxes or 100% of your current year’s to avoid penalties.

The remainder of this post is to show you how to do this yourself through your payroll provider. The payroll provider displayed is the Red Earth preferred payroll provider, Gusto.

First figure what your prior year’s tax amount from last year’s tax return.

Open your prior year’s tax return. The amount you will use for your calculations will be from Line 24, total tax (for tax year 2021). For the prior year, it looks like this:

![]()

If your income is under $150k, use this amount. If it is over $150k, multiply this amount by 110%. You now know your current year’s required estimates.

Determine your current federal withholdings.

The total tax amount above is what you’ll need to pay to avoid penalties. However, you are likely withholding taxes through box 2 of your W2 (shown above). If you have not changed your withholding since last year, you can use the prior year’s withholding as a guide.

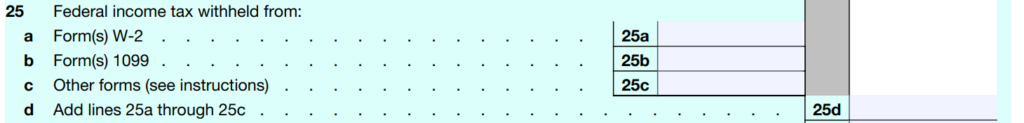

Your prior year’s withholding are found on line 25 “a” for W2s. Line 25 looks like this:

If withholdings have not changed significantly, you can subtract line 25 from line 24 to find the amount you’ll need to withhold.

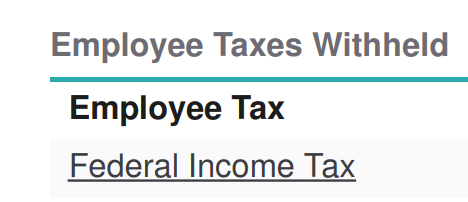

If your current year’s withholdings have changed, you will want to calculate your expected withholdings from your paycheck. Multiply the expected annual payrolls (12, 24, 26, etc.) by the federal withholding listed on your pay stub. Look for the amount withheld next to “Federal Income Tax”:

Continuing our example of John, if he is currently withholding $1,000 per paycheck for federal income tax and is paid bimonthly, he will have annual withholdings of $24,000.

Calculate the amount of taxes due for the current tax year.

Armed with the prior year’s taxes and the current withholding, you can now calculate the minimum taxes due this year to avoid penalties. For this, you will subtract the withholding from the total tax.

In our example, the total tax (line 24) is reduced by this annual withholding of $24,000 to find your estimated taxes due. If your current year’s taxes are $137,500, you will subtract $24,000 to arrive at $113,500 of federal income taxes due.

Divide the amount due among the number of pay periods for the tax year.

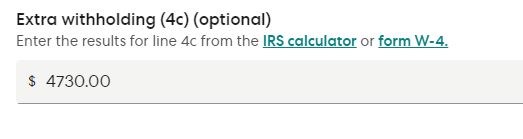

This total amount of taxes due is then divided by the pay periods. In our example, the $113,500 is divided by 24 to arrive at $4,730. This amount is the amount of additional withholding required to avoid penalties. This is not the total amount of withholdings.

You will add this amount to the current withholdings for your new number. In the example, the $1,000 of current withholding is added to the $4,730 to equal $5,730.

(Check this number to see if it is your intended amount by calculating the number of pay periods by the total withholding. In our example, 24 X $5,730 = $137,520 in annual withholding.)

Increase your withholdings in your payroll software by the additional amount.

You have now found your prior year’s tax amount, current year’s withholding and calculated the amount of additional withholding to avoid any penalties. It is now time to increase your withholdings so you can avoid penalties for not paying quarterly estimated taxes.

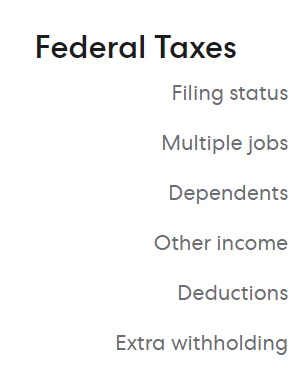

In Gusto, navigate to the team member area for the people to update. Find the additional withholding information in your payroll software.

Click the “Extra withholding” area, and add the additional amount.

Don’t forget about prior payrolls in the current year.

This option works best when starting fresh with a new tax year in January. If you are starting any other time in the year, you’ll need to calculate the amount that should have been sent to the IRS and manually send this.

For example, if you get around to this when thinking about your prior year’s tax bill on April 15th of the current year, you’ll need to calculate the additional withholding for the current year and send that in manually for your 1st quarter estimated tax due on April 15th.

In our example, this would be the $4,730 (additional tax only) multiplied by the number of payrolls. Bimonthly from the beginning of the year through April 15th amounts to 7 pay periods. Seven times $4,730 = $33,110, the amount to send in as you increase withholdings.

Be sure to remit the total amount of the missing payments when you increase withholdings so you’re not caught with a penalty.

Go back to running your business and quit worrying about tax penalties.

Now that you’ve automated your estimated payments by running them through your payroll system, you don’t need to think about the highly irregular estimated tax calendar cycle. You can now focus on your business without worrying about big checks to write four times a year.

Red Earth CPA cares about business owners investing their energy in high-value activities to move their businesses forward. Estimating taxes is not one of those tasks.

We are building a company to support business owners with accounting tasks to alleviate unnecessary administrative stress for business owners. We want business owners to focus on their most productive tasks. To get in touch with us, use our connect form here.